Isn’t there a mechanism to rid the New York Stock Exchange of the corpses underfoot? Apparently not, as Comstock Mining Inc [LODE], the gang that couldn’t mine straight, has become the corporate equivalent of the Walking Dead. It is lifeless, but lingers on.

BulletinJust as this Update was about to launch, Comstock Mining Inc fired off a press release announcing its new lease on life. By mortgaging every non-mining asset it owns, CMI has gained access to new millions of dollars which it intends to use to pit mine Silver City. Details below. |

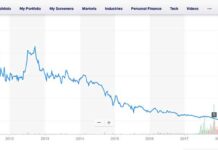

Its stock value at the NYSE fell to 20 cents in November, and is fluttering down around a quarter now. The company hasn’t mined for many months and shows no prospect of resuming, having burned through $200,000,000+ of stockholders’ money over five years without making a nickel.

One of my neighbors said, “Don’t feel sorry for their suckers, they deserved to lose their money.” I don’t feel sorry for the shareholders losing money — well some of them I do — I feel sorry they’re blind. Yes, once upon a time the Comstock Lode was “The Richest Place on Earth” but only a handful of the great mines were profitable in the usual sense of the word. The rest were losers, generating profits for the stockbrokers but not for the stockholders.

Sometime between March 9th, 2012 and April 15th, 2013 CMI took its motto down from the home page of its website. “Revitalizing the Comstock Lode”, the company had bragged up until then. Still, the jolly Christmas lights shined as bright as ever.

|

Christmas 2013 |

|

Christmas 2015 |

|

Christmas 2016 |

The motto was removed as CMI was becoming the biggest loser in the history of the Comstock Lode. Its legacy is the big hole in the ground by Devil’s Gate, as eternally empty as John Winfield’s promises.

And so it turns out that the Comstock Lode has devitalized CMI instead. And yet the company is still staggering around, dead but alive.

Also Alive:

Two law suits involving Lyon County and CMI have reached the Supreme Court.

In the first of them the Comstock Residents Association and citizen Joe McCarthy of Silver City filed suit against the Lyon County Commission over its capricious rezoning of Silver City to allow pit mining within the town limits.

Here the County suffered a setback. The Nevada Supreme Court reversed the District Court order that squelched our due process claim and remanded it back for further proceedings.

On the other two issues The Supreme Court affirmed the lower court’s dismissal of the open meeting claim, Justice Cherry dissenting, and it affirmed the finding that the Commissioners had substantial evidence supporting their action.

The second suit was filed by Comstock Residents Association to forbid the Lyon County officials using personal email for public business, thus avoiding oversight, has also reached the Supreme Court.

The second suit was filed by Comstock Residents Association to forbid the Lyon County officials using personal email for public business, thus avoiding oversight, has also reached the Supreme Court.

The Court ruling acknowledged the most important claim in the lawsuit: the violation of Silver City’s due process rights by the Lyon County Commission. They remanded it back to the lower court for a do-over. A copy of the order is here.

The Court upheld the other two claims because CRA could not prove the backroom dealings that took place via email — because Lyon County denied access to personal communications by the commissioners and staff, thus concealing the influence peddling from the public.

The Las Vegas Review-Journal, the Nevada Press Association and the Washington Times have all posted scathing editorials blasting the District Court and the Lyon County Commission for allowing corrupt dealing.

The Las Vegas Review-Journal, the Nevada Press Association and the Washington Times have all posted scathing editorials blasting the District Court and the Lyon County Commission for allowing corrupt dealing.

The Review-Journal’s Editorial on backroom deals was a reminder of the poster Steven Saylor produced for the company. It shows Corrado De Gasperis and John Winfield palling around with some of Nevada’s most respected and influential political people. It suggests that the CMI executives are of equal stature, and have their complete confidence. Governor Sandoval is even depicted taking dictation from Corrado, while John Winfield beams with satisfaction at the toast former Governor and Senator Richard Bryan is lifting in his direction.

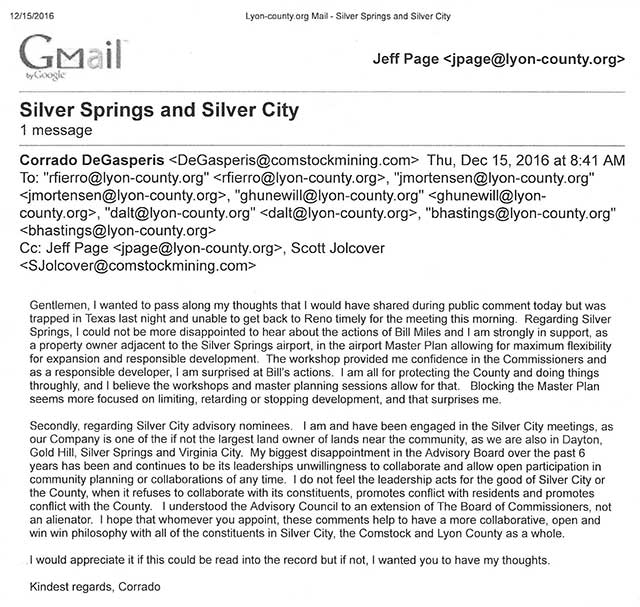

| On December 16th Silver City Citizen Advisory Board Chairman Erich Obermayr sent this letter to his fellow citizens: All my friends and neighbors, As you probably know by now, I was not reappointed to the Silver City Citizen Advisory Board at the [Lyon County] Commission meeting yesterday.

The Commissioners instead reappointed Cal, and added Chali and Cristee. I think they will do a fine job, and I’m especially happy to see Chali on the board as the town sorely needs the perspective and energy of the younger generation. I am arranging a meeting with Cristee and Cal (Chali will be out of town) to make sure the “transition” goes smoothly. I can’t say I’m happy with what the commissioners did, but I’m basically ambivalent about it. It was certainly not unexpected, and is finally very predictable given the characters who currently populate the Lyon County BOCC. Over the last couple of years I’ve provided them with no shortage of rationalizations for giving me the boot. And really the strongest feeling I have is that of a weight lifting from my shoulders—not the weight of being a board member and speaking out for my community —but the grim toil of trying to get the County Commission to understand, or at least acknowledge, the people of Silver City, our town, and our values. I certainly won’t disappear from the scene, by any means, but I’m looking forward to a lot more free time. I promise I will finish up on a positive note, but bear with me for a bit. I have included here an email from Corrado de Gasperis, to the Commissioners, expressing his opinion regarding the issue at hand. And I really do apologize for bringing it into your lives, but in reading it over I realized how succinctly it captured the last six years of dealings between Silver City and Comstock Mining, Inc. Its tone, of course, is one of arrogance and condescension—the privileged interloper who arrived six years ago to “revitalize” us. And we, or the advisory board leadership, or . . . me, have disappointed him. We are a strong community, we know what we have here, and we are not about to give it up to become bit players in some misbegotten, alien fantasy. The rest of the letter speaks for itself, and I’m happy to let you all be the judge of its truthfulness without comment. As I promised, I’m so looking forward to the Christmas party tomorrow night. Corinna’s even going to be there. And by the way, thank you for all the kind words, support, good thoughts, delicious bread, pats on the head—all of it. |

The Double Dime and CMI stock On Veterans Day 2016, shortly after the hallowed hour of 11 am, the share price of Comstock Mining Inc [LODE] stock fell below 20¢. It rebounded at noon to a tick above, and on the last day of November, after fluttering around as if the plaything of day-traders, closed at 23¢. At close of market January 31st it was 24¢. |

BULLETIN!

On January 17 the Company announced it had issued an 11% Senior Secured Debenture due 2021 in the amount of $10,723,000. “The Debenture is secured by the pledge of the equity interests in all of the Company’s subsidiaries and substantially all of the Company’s assets. The Company is required to prepay the Debentures with the net cash proceeds from the sale of previously disclosed non-mining properties, subject to customary reinvestment rights.

“Until January 1, 2019, interest will be payable in cash and/or in the form of additional Debentures, at the Company’s option. Thereafter, interest will be payable in cash. The Company has the right to redeem the Debenture, at any time, at a redemption price equal to the outstanding principal balance, plus accrued and unpaid interest and a make-whole amount equal to seven months of interest. The Debenture also includes customary default and cure provisions and, in the event of certain defaults, a default interest rate of 13.5%.”

The more detailed SEC filing is here.

So CMI has pushed all its chips into the center of the table, betting everything it has left on the prospect of pit mining Silver City.

I must say it has never been the task of anyone on the Silver City Advisory board to refrain from “disappointing” him or anyone else, no matter how much property they own. When he laments the six-year refusal to “collaborate,” he is talking about my refusal—our refusal—to give ourselves over, on his and his company’s terms, to an imposed reality in which residents of Silver City live happily ever after next door to an open pit mine. That’s the story of the last six years.

I must say it has never been the task of anyone on the Silver City Advisory board to refrain from “disappointing” him or anyone else, no matter how much property they own. When he laments the six-year refusal to “collaborate,” he is talking about my refusal—our refusal—to give ourselves over, on his and his company’s terms, to an imposed reality in which residents of Silver City live happily ever after next door to an open pit mine. That’s the story of the last six years.