Bulletin!In his 3rd Quarter conference call, in addition to the usual quarterly loss, Corrado De Gasperis announced a 5 to 1 reverse stock split, to be effective November 10th. This is good news for CMI; not only does it prevent delisting from the NYSE, it provides more room at the bottom for the price to fall. LODE closed the day at just under 12 cents. If it holds at that price until the 10th, our 10 shares will be reduced to 2, worth something less than 60 cents each. Should we be pleased? Worth noting: CMI’s stock was at 60 cents a share most recently 2½ years ago, at the end of May, 2015. Let’s see how long it takes to sink below 12 cents this time. |

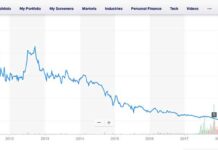

There hasn’t been much to report about Comstock Mining Inc. since the company was put on notice by the NYSE in May that by November 27th it must improve its stock price or be delisted.

The long slow slide of its stock price could hardly be described as news. We felt a mild curiosity about Corrado De Gasperis’ promise of a transformative Joint Venture to be announced later in the year, but our previous experience with CMI promises has robbed us of our credulity.

If the “Conversations” page on Yahoo can be believed though, some of the stockholders fell for it. “Corrado stated the Joint Venture is a real thing and it is in advanced talks,” wrote one of them [‘Kyle’]. “Will most likely be agreed upon. Corrado said he will not announce the companies involved until finalized… which won’t be until late August to Mid-September.”

CMI Law Suit UpdateCRA’s public records lawsuit against Lyon County and CMI has been scheduled for Oral Argument at the Nevada Supreme Court in Carson City. The 30-minute hearing will be held Tuesday November 7th at 2 pm. CMI was named in the suit because of the suspicions about Lyon County officials’ ‘below the radar’ meetings with company executives prior to the Lyon County Commissioners overturning the long-standing prohibition against pit mining within the Silver City town limits. The crux of the case revolves around the use of private email accounts to conduct the public business. The suit was filed when the defendants refused CRA’s request for electronic communications contained on their personal devices. The issue is essentially the same as the one that was so costly to Hillary Clinton not so long ago. |

But a more skeptical voice [‘Anthony’] cautioned “I don’t think too many people actually read the transcript very carefully. Unbelievable responses from Corrado; he said he’s negotiating with 5 potential JV partners, 3 private and ‘maybe 2’ publicly traded. He called it a ‘hodgepodge.’ When asked point blank which exchanges they are traded on, he said he didn’t know, ‘maybe U.K.’ Really? how could you be having serious discussions with a company and not know where they’re trading? He also said CMI doesn’t need any joint venture, that they can do it all themselves. Sounds like a lot of double talk to me. Something is seriously wrong here.”

When the first Joint Venture was announced, it was with Cycladex Inc., which announced in its turn, “Cycladex is working with a well established gold mining company from which it received an initial $300k investment in its seed round.” Cycladex has developed a cheaper process for processing gold ores not involving cyanide, and CMI reported on July 18 that tests at American Flat on materials from the Dayton Con in Silver City were positive.

Perhaps because all involved know the “well established” CMI is barely hanging on by its corporate fingernails, these announcements didn’t budge its stock price. It was at 20 cents on the 18th, fell to 19 the next day, and then bounced around for a few days, getting all the way to 21 cents on July 31st. From there it has been a jagged downhill slide.

But when a second Joint Venture was announced on October 5, the reaction was immediate: “WTF?”

Instead of a larger company with the assets to finance CMI’s efforts to resume mining, the new partner — Tonogold [TNGL] — is not only smaller and broker than CMI, its stock is not listed on any stock exchange; it is only traded Over The Counter. In the wake of the announcement, TNGL shares surged from 9 to 15 cents (it has been as low as 2 cents), LODE went from 14 cents to 15.

On 10/17/2017 the ever-cynical ‘Anthony’ posted: “TNGL traded a total of 1000 OTC shares on monday, for a total of $92.50”.

These two corporate refugees seemed desperate to improve their lot, clinging together for warmth as they creep into a leaky boat, low in the water and slowly settling.

But despite the diminutive nature of the principals, the Joint Venture won’t be nothing to those of us who live here and must live with the consequences. TNGL in announcing the agreement says the company is paying $200,000 for a 6-month option (extendable for an unknown period for another $2 million) to buy 51% of, and take over active management of, the “Lucerne properties” in Gold Hill for $20 million.

TNGL has $200,000 in the bank — heck, it has $325,000! — and claims commitments from private investors for another $1 million to carry out its due diligence in testing and analysis of the Resource.

In its press release TNGL quotes the ever quotable Corrado de Gasperis as saying, among other things: “We have the right partner with the right capital support to maximize the value of the Lucerne operation.”

Huh?

But then TNGL points out some of the ways its people can do better than Corrado’s did. For one, “there is evidence that the official resource estimate may have been overstated by over 30%”. For another, “The Official Resource for Lucerne includes mineralization down to 1,520 feet (463 meters). Tonogold believes that mineralization below 820 feet (250 meters) would not, at this time, meet the “reasonable prospects for economic extraction”.

Also, “The cutoff grade assumed of 0.007 o/t Au (0.24 g/t Au) is, in Tonogold’s opinion, far too low given the prior operating conditions. Tonogold believes that even with the economies of scale expected to be achieved in future operations, a cutoff grade of 0.02 o/t Au (0.69 g/t Au) would be more appropriate. Based on Comstock’s Resource statement, this would reduce the pre-mined Resource from 2.14 million ounces of gold to 1.55 million ounces

So TNGL thinks it is smarter than LODE.

That’s easy opinion for Comstockers to accept because we’ve seen LODE in action since 2010, losing — what is it? $200 million? More? — for its investors. And now TNGL has six months to determine if 51% of the Lucerne pit is worth the $20 million it would cost.

While that’s going on, CMI continues to threaten the destruction of Silver City.

Having banked an urgently needed $200,000 and achieved an exit opportunity from the fiasco of the Lucerne Pit, The company plans to begin the permitting process for pit mining in Silver City by the end of the year.

“We are marching toward Dayton feasibility come hell or high water,” says CMI CEO De Gasperis. The company hopes to conduct additional exploratory core-drilling at the Dayton Con in the near future, funded by the sale of non-mining assets, one of which is the Gold Hill Hotel and another a piece of undeveloped industrial-zoned ground near the Silver Springs airport with others in between.

The effect of pit mining in this small quiet community would be catastrophic, but the Lyon County commissioners seem willing to consider abandoning the town to its fate. Silver City is fighting back. Local citizens have launched a website to coalesce support for protecting the town from the unwelcome intrusion of the dust, noise and traffic that comes along with heavy industry.

CMI’s feckless performance in Gold Hill over the past seven years should be a warning to the Lyon County Commissioners, but no-one is betting that it will. Indeed, CMI is betting that it won’t.